A Preview of The 5 Years Before You Retire with Emily Guy Birken

A summary of things you should know about The 5 Years Before You Retire according to Emily Guy Birken:

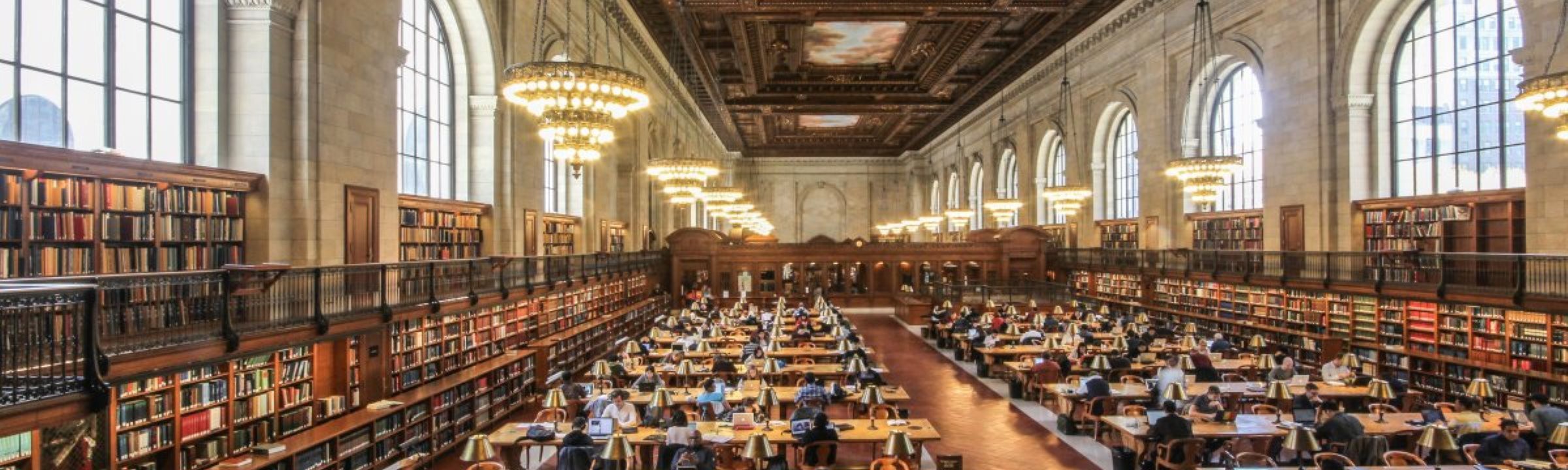

Introduction

In this episode Emily Guy Birken takes a deep dive into her book, The 5 Years Before You Retire, where she reveals a comprehensive guide to planning your retirement early.

In her book Birken gives you a complete overview of retirement planning with simple strategies that explain how you can maximize your last years before retiring through conservative financial decisions. The goal of the book is to help you save money for your future, get the most value from your 401K, and maximize your current savings that is realistic for years to come.

This book is perfect for entrepreneurs who have a very basic understanding of what it takes to retire and need a simple yet comprehensive guide that will educate on the early steps of retirement.

The Book’s Unique Quality (2:46)

The big thing is that I am focusing very specifically on the actions that the reader needs to take to be prepared.

The Best Way To Engage (3:32)

For the people who don’t have a background in finance and who are just now thinking retirement for the first time, it makes sense to start on the first page and read through to the end. For those who have been saving for a while and feel like they got a good handle on some things, I would suggest jumping around to the part of the book that fits their needs best.

The Reader’s Takeaway (12:43)

I would say to manage your expectations. It’s not bad to dream about all the things you want to do but you must remember that retirement cannot solve all your problems. You need to manage your expectations and find your contentment within yourself.

A Deep Dive Into The Book (4:28)

I have the book broken up into three parts. Part One is about the nitty-gritty of your finances for retirement. Part Two I call The Government Giveth and Taketh Away. And Part Three is Home, Family, and Other Considerations.

In the first part, The Nitty-Gritty of Your Finances, I start by helping you figure out how far away you are, how much money you have, and how much money you might need. I liken saving for retirement to be similar as starting a weight loss journey. The first thing you have to do is know where you are. So if you are starting a weight loss journey you have to first step on the scale and if you are starting a retirement journey you have to figure out how much money you have and how much you will need.

The first two chapters are all about figuring out what you can count on and how much you will need to live comfortably. And then the second chapter is all about maximizing your savings and your budgeting over the last few years before retirement.

The third chapter is about how to structure your income in retirement.

The fourth chapter is on how to find the right financial planner. I am a daughter of a financial planner and have a very rosie view of financial planning but I also want to make it clear that you need to be your own advocate in finding a financial planner. I go through all the different ways of what you need to do to find a financial planner that you can work with and trust including questions to ask.

From there I talk about what to expect from Medicare. There are a lot of potations for Medicare and it’s a little overwhelming so it’s a good idea to know what to expect before getting into retirement.

Finally, I talk about how to plan for healthcare options in retirement.

The final section, Home, Family, and other Considerations, I talk about what your housing options are in retirement and that includes staying in your home to moving into a retirement community. I also cover things like reverse mortgages and how that can work. I talk about family fortunes, how your retirement will affect your children, your grandchildren, and potentially your elderly parents.

I also talk about creating a budget on a retirement income.

The last two chapters I cover common retirement pitfalls and the 10 possible things you could do that would screw up your retirement. I go through what these common pitfalls are and show you how to avoid them.

Finally, I talk about what to do if you don’t have enough saved and what your options are in that situation.

NOTE: That was just a summary. To get the full deep dive, play the audio clip at 04:28

Notable Quotes From The Book (13:42)

“If you plan to retire you need to recognize that you can only count on your own actions.” – Emily Guy Birken

The Credibility/Inspiration Of The Author (0:35)

I am a Personal Finance writer; I write on the internet, on many different sites. I’m also an author and currently on my second book on retirement called Your Retirement Path.

I was frustrated by the fact that retirement planning books all seemed to focus on younger workers, those who are in their 30’s and 40’s. And then there are some books on stretching your budget for those who are already retired but there didn’t seem to be any guides available for that crunch time in those five years before you retire. I wanted to fill that gap for those who are looking at retirement in the very near future.

Other Books Recommended By The Author (15:09)

Your Money or Your Life by Vicki Robin and Joe Dominguez

More Information About This Book and The Author

Buy The 5 Years Before You Retire by Emily Guy Birken on Amazon today

Visit the personal website of Emily Guy Birken

Follow Emily Guy Birken on Twitter and Facebook

UPDATE: Stay tuned for Choose Your Retirement by Emily Guy Birken which is set to be available later in October 2015.

More Information About This Episode

Download the full transcript here (coming soon)

Listen on iTunes, Stitcher , and SoundCloud

Related books:

You Can Retire Sooner Than You Think by Wes Moss

Get What’s Yours by Larry Kotlikoff

The 30 Year Paycheck by sander Biehn

What did you like and not like about this episode? Fill out this one minute survey here.

The Entrepreneurs Library

The Entrepreneurs Library